|

In

light of the recent financial and economic woes, the

“bailout” of Fannie Mae and Freddie Mac, the recent

trillion

dollar mortgage “bailouts”, the crash of the housing market,

and the resulting huge swings in the stock market and the

predicted runs on banks, I felt it would be appropriate to

discuss The Federal Reserve System (aka “The Fed”) and its

history.

I

remember in 2008 when

Congress was attempting to pass the $700 billion “bailout,”

I was sitting in the San Antonio airport waiting for a

flight to Nashville. I watched several “financial experts”

express their opinions on the pros and cons of the bailout,

and as I listened, it seemed that at least once per sentence

someone would refer to “The Fed.” I had to chuckle to myself

as these supposedly sophisticated people (representatives

of our largest and most prominent financial institutions and

“think tanks”) were obviously ignorant of the truth

about “The Fed.” I

remember in 2008 when

Congress was attempting to pass the $700 billion “bailout,”

I was sitting in the San Antonio airport waiting for a

flight to Nashville. I watched several “financial experts”

express their opinions on the pros and cons of the bailout,

and as I listened, it seemed that at least once per sentence

someone would refer to “The Fed.” I had to chuckle to myself

as these supposedly sophisticated people (representatives

of our largest and most prominent financial institutions and

“think tanks”) were obviously ignorant of the truth

about “The Fed.”

You

see, the simple truth is that The Federal Reserve System is

neither

“federal,”

nor does it have any

“reserves.”

The Fed is a system of private banks, owned by

rich foreign and American bankers. It is the biggest scam

ever perpetrated upon the American people. The Fed is the

reason we have inflation and an enormous national debt,

which, by the way, will NEVER be paid off, since The

Fed would rather have the interest on the loan (the national

debt) than the principal, because they make trillions

of dollars from the US being in debt.

“But

wait a minute! Doesn’t the US government control The Fed?

Doesn’t the President appoint the Chairman of the Federal

Reserve?” Well, yes, the President does appoint the

Chairman…but NO, the US government does NOT control

The Fed. Quite the opposite. The Fed actually

controls the US government. Baron M. Rothschild once wrote,

“Give me control over a nation’s currency and I care not

who makes its laws.” Well, The Fed not only controls the

US currency, but it also controls our politicians.

THE

MEETING AT JEKYLL ISLAND:

Back

in 1910, Jekyll Island (an island off the coast of Georgia)

was privately owned by a small group of millionaires from

New York, including William Rockefeller and J.P. Morgan.

Their families would travel to Jekyll Island to spend the

winter months. There was a brilliant structure there, the

clubhouse, which was the center of their social activities.

The island has since been purchased by the state of Georgia,

converted into a state park and the clubhouse has been

restored. If you were to visit the clubhouse and walk

downstairs, you would come to a door with a plaque stating:

“In this room the Federal Reserve System was created.”

In

November of 1910, Senator Nelson Aldrich sent his private

railroad car to the railroad station in New Jersey. From

there, he and six other men traveled under the cloak of

secrecy to Jekyll Island. They were told to arrive

separately at the railroad station, not to eat together, not

to speak to each other, and to act like they were

strangers. They were told to avoid newspaper reporters

since they were well-known people, and reporters would have

wondered why these seven prominent men were all traveling

together. In

November of 1910, Senator Nelson Aldrich sent his private

railroad car to the railroad station in New Jersey. From

there, he and six other men traveled under the cloak of

secrecy to Jekyll Island. They were told to arrive

separately at the railroad station, not to eat together, not

to speak to each other, and to act like they were

strangers. They were told to avoid newspaper reporters

since they were well-known people, and reporters would have

wondered why these seven prominent men were all traveling

together.

Once

they got on board the train, the deception continued. They

were told to use first names only, not to use their last

names at all. A few of the men used pseudonyms. Once they

arrived at Jekyll Island, they spent over a week hammering

out the details of what eventually became the Federal

Reserve System. When they were done they went back to New

York.

After

the meeting at Jekyll Island, for several years, these men

denied that there ever was a meeting. It wasn’t until after

the Federal Reserve System was established in 1913 that they

then began to talk openly about their secretive trip and

meeting at Jekyll Island. As a matter of fact, they wrote

books, magazine articles, and gave interviews to reporters,

so now it’s possible to go into the public record and learn

exactly what happened there off the coast of Georgia.

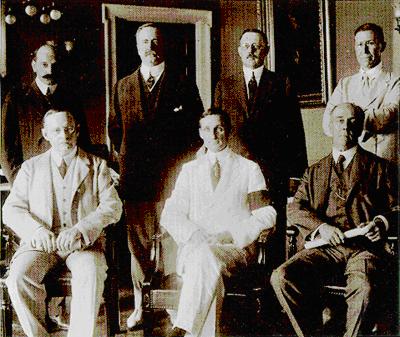

WHO WERE THE SEVEN MEN?

Senator Nelson Aldrich, whom I have already mentioned,

was a Republican Senator and was the chairman of the

National Monetary Commission. He was also the very

important business associate of J. P. Morgan and was the

father-in-law of John D. Rockefeller, Jr. and was the

grandfather of Nelson Rockefeller.

Also

in attendance at Jekyll Island was Abraham Andrew,

who was Assistant Secretary of the Treasury. Henry

Davison, the senior partner of the J. P. Morgan Company,

was in attendance, as was Charles Norton, the

President of the First National Bank of New York.

Benjamin Strong, the head of J. P. Morgan’s Banker’s

Trust Company, was at Jekyll Island, and in 1913, when the

Federal Reserve Act was passed, Strong became the first head

of The Fed. Also

in attendance at Jekyll Island was Abraham Andrew,

who was Assistant Secretary of the Treasury. Henry

Davison, the senior partner of the J. P. Morgan Company,

was in attendance, as was Charles Norton, the

President of the First National Bank of New York.

Benjamin Strong, the head of J. P. Morgan’s Banker’s

Trust Company, was at Jekyll Island, and in 1913, when the

Federal Reserve Act was passed, Strong became the first head

of The Fed.

Frank Vanderlip, the President of the National City Bank

(NCB) of New York, was an attendee at Jekyll Island. NCB

just happened to be the largest of all of the banks in

America representing the financial interests of William

Rockefeller and the international investment firm of Kuhn,

Loeb & Company.

Finally, there was Paul Warburg who was almost

certainly the most important at the meeting because of his

familiarity with banking as it was practiced in Europe.

Paul was one of the wealthiest men in the entire world. He

was a partner in Kuhn, Loeb & Company and was a

representative of the Rothschild banking dynasty in France

and England. He maintained very close working relationships

with his brother, Max Warburg, who was the head of the

Warburg banking consortium in Germany and the Netherlands.

These

were the seven men aboard that railroad car who were at

Jekyll Island. According to G. Edward Griffin, author of

The Creature from Jekyll Island, as amazing as it may

seem, they represented approximately 1/4 of the wealth of

the entire world! These are the men that sat around

the table and created the Federal Reserve System.

WHY WAS SECRECY IMPORTANT?

You

might ask, “What is the big deal about a group of bankers

getting together in private and talking about banking?”

According to Vanderlip, “If it were to be exposed

publicly that our particular group had gotten together and

written a banking bill, that bill would have no chance

whatever of passage by Congress.” You see, the purpose

of the bill was to break the grip of what was referred to as

the “money trust,” which was the concentration of

wealth in the hands of a few large banks in New York on Wall

Street . . . and it was written by the money trust!

Had that fact been known from the beginning, the US would

never have had a Federal Reserve System because as Vanderlip

said, Congress would never have passed it. It would have

been like hiring the fox to install the security system at

the henhouse. This was why secrecy was so important. The

goal was to create a “central bank” much like those in

existence in Europe for centuries.

How

could they conceal that from the American people? Congress

was already on record as saying they did not want a

central bank in America. Their challenge was to create a

central bank that nobody would know was a central bank. This

was their strategy: first, they would give it a name and

including the word “Federal” so that it appears to be an

official government entity. Then they would add the word

“Reserve” so that it would appear there were reserves

somewhere. Then, they would add the word “System” so that

it would appear that there was a system of regional banks

which would spread power over the entire country and remove

the concentration of financial power from New York City.

When you analyze it, you will realize that what they created

there was not federal, there are no reserves,

and it’s not a system at all in the sense of

diffusion of power. It was brilliant strategy.

CONVINCING THE PUBLIC:

The

next thing was to “sell” The Fed to the public. The first

draft of the Federal Reserve Act as it was presented to

Congress was called the Aldrich Bill (named after the

sponsor, Senator Nelson Aldrich). However, since

Aldrich was so identified with big business interests, the

people were outraged and Congress voted it down. But, just

like Congress does today, they took the bill, rearranged the

paragraphs, took Aldrich’s name off the bill and found a

couple of Democrats (Carter Glass and Robert Owen) to

sponsor the new bill. Since everybody “knew” that the

Republicans represented big business and that Democrats

represented the “common man,” this was a brilliant move. The

Aldrich Bill had morphed into the Glass-Owen bill, and the

new bill was perceived as being totally different from the

Aldrich Bill.

The

next step was for Aldrich and Vanderlip to give speeches and

interviews to newspaper reporters condemning the

Glass-Owen Bill. They would frequently state that the new

bill would be “ruinous to banking and terrible for the

country.” By the time the American public would read

that comment in the local newspaper, he would gullibly say,

“Gee whiz, I reckon if the big bankers don’t like the

bill very much then it must be pretty good.”

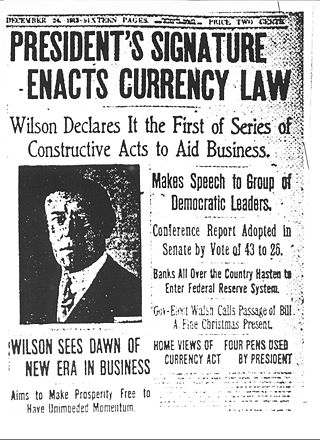

With

this kind of expert tactics and deception, the public didn’t

stand a chance. It is no surprise that popular support was

finally gained for the bill and on December 22, 1913 the

bill was passed by Congress and the following day was signed

into law by President Wilson. With

this kind of expert tactics and deception, the public didn’t

stand a chance. It is no surprise that popular support was

finally gained for the bill and on December 22, 1913 the

bill was passed by Congress and the following day was signed

into law by President Wilson.

As

author G. Edward Griffin states, “the creature from

Jekyll Island finally moved into Washington, DC.” After

the passage of the Federal Reserve Act, Congressman Charles

Lindbergh stated: “This Act establishes the most

gigantic trust on earth....When the President signs this

Act, the invisible government by the money power, proven to

exist by the Money Trust Investigation, will be

legalized....The new law will create inflation whenever the

trust wants inflation....From now on, depression will be

scientifically created.” That’s right, Lindbergh stated

that future depressions would be “created” by the bankers.

Louis

McFadden, Chairman of the House Banking Committee during the

1930s, said about the stock market crash of 1929: “It was

not accidental; it was a carefully contrived occurrence. The

international bankers sought to bring about a condition of

despair so that they might emerge as ruler of us all.”

Since 1913, the Federal Reserve Act has been amended over

100 times, with each amendment expanding the power and reach

of the Federal Reserve System to “create money out of

nothing.”

THE “MANDRAKE MECHANISM” - MONEY OUT

OF NOTHING:

The

passage of the Federal Reserve Act in 1913 was the beginning

of the partnership between a cartel of private bankers and

the US government. This is VERY IMPORTANT. Cartels

often go into partnership with governments because they need

the force of law to enforce their cartel agreement. I have

heard many economists refer to The Fed’s process of creating

money from nothing as the “Mandrake Mechanism” named after

the comic-book character of the 1940s, Mandrake the

Magician, who could create something out of nothing.

Let’s

take a simplified look and see how they create money through

the Mandrake Mechanism.

Here’s how it works. It starts with the government side of

the partnership, it starts in Congress which only knows how

to spend, spend, spend. Let’s say Congress needs an

extra billion dollars today so it goes to the treasury and

says “we need a billion dollars” and the Secretary of

the Treasury says “you’re crazy, we’re plum out of money,

we ran out of the tax money back in May.” Congress

then gets together and strolls down Constitution Avenue and

stops at the local Kinko’s and prints off some “official” US

Government bonds, which are really nothing more than fancy

IOU’s. After printing a billion dollars worth of these

bonds, they offer them to the private sector (i.e. the

American sheeple). Well, tens of thousands of Americans are

anxious to lend their money to the government, since they’ve

been told by their trusted investment advisors that this is

the most sound investment that you can make, since these

bonds are backed by the “full faith and credit of the US

government.” They’re not quite sure what that means but

it sure sounds good. Let’s

take a simplified look and see how they create money through

the Mandrake Mechanism.

Here’s how it works. It starts with the government side of

the partnership, it starts in Congress which only knows how

to spend, spend, spend. Let’s say Congress needs an

extra billion dollars today so it goes to the treasury and

says “we need a billion dollars” and the Secretary of

the Treasury says “you’re crazy, we’re plum out of money,

we ran out of the tax money back in May.” Congress

then gets together and strolls down Constitution Avenue and

stops at the local Kinko’s and prints off some “official” US

Government bonds, which are really nothing more than fancy

IOU’s. After printing a billion dollars worth of these

bonds, they offer them to the private sector (i.e. the

American sheeple). Well, tens of thousands of Americans are

anxious to lend their money to the government, since they’ve

been told by their trusted investment advisors that this is

the most sound investment that you can make, since these

bonds are backed by the “full faith and credit of the US

government.” They’re not quite sure what that means but

it sure sounds good.

Now,

after selling half a billion of US bonds, Congress still

needs more money…after all, they’ve got a spending

addiction. They’ve already milked the American public with

the issuance of the bonds, so the next day they stroll down

to the Federal Reserve building. The Fed has been waiting

for them – that’s one of the reasons it was created. By the

time they get inside the Federal Reserve building, the Fed

officer is already opening up his checkbook, and he writes a

check to the US Treasury for half a billion bucks.

WHERE

DOES THE MONEY COME FROM?

You

might be asking, “Where did The Fed get half a billion

dollars to give to the US Treasury?” Did they have

$500,000,000 in their account? The startling answer is

there is no money in the account at the Federal

Reserve System. NONE. In fact, technically, there

isn’t even an account, there is only a checkbook. That

billion dollars springs into being at precisely the instant

the officer signs that check and, if you remember in

Economics 101, that is what the professor called “monetizing

the debt.” This is how the government gets its instant

access to any amount of money at any time

without having to go to the taxpayer directly and justify it

or ask for it. Otherwise, they would have to come to the

taxpayer and say we’re going to raise your taxes another

$7,500 this year. Of course, if they did that, then the

American taxpayer would vote them out of office quick, fast,

and in a hurry. No, Congress really likes the Mandrake

Mechanism because it’s a “no questions asked” source of

instant cash.

Now,

this is where it really gets interesting. Let’s go

back to that half billion dollar check that the Fed official

just wrote. The Treasury official deposits the check into

the government’s checking account and all of a sudden the

computers indicate that the government has a billion dollar

deposit. So now the government can write a billion dollars

in checks against that deposit, which Congress does very

quickly, as they are going through withdrawals from not

having enough money for their “spending sprees.” For the

sake of our simplistic analysis, let’s just follow $100 out

of that half a billion. Let’s say Congress writes a $1000

check to Johnny, who cuts the lawn at the White House. He

gets a check for $1000, completely clueless that only a day

before, this money didn’t even exist, but he doesn’t care,

so he deposits it into his bank account. Now, the bank

manager sees that a $1000 deposit has been made he runs over

to the loan window and opens it up and says “Attention,

attention, we now money to loan.” Everyone is

thrilled since that’s one of the chief reasons that people

go to banks, right? They want to borrow money.

Well,

it just so happens that Freddie (Johnny’s neighbor) needs to

borrow $900 for a home renovation. The Federal Reserve

System requires that the banks hold no less than 10% of

their deposits in reserve, so the bank holds 10% of that

$1000 in reserve ($100) and it loans Freddie the $900 he

needs for his home renovation. What do you think Freddie

does with the $900? He wants to spend it so he puts it into

his checking account. When he puts this $900 into his

checking account, it’s considered a deposit, then the bank

is only required to keep $90 in deposits and can turn around

and loan out $810. The next fellow also needs a loan, so he

borrows the $810, deposits it into his checking account, and

then the bank has more deposits which can, in turn, create

more loans. At the end of the day, the bank can eventually

loan out $9000 based on the initial $1000 deposit, as a

result of the 10% fractional reserve requirement.

Where

did the $9000 come from? The answer is the same as when the

Fed officer wrote the check… there was no money. The

money is “created” precisely at the point at which the loans

are made. Think about this for a minute. This money was

created out of nothing and yet the banks collect interest on

it which means that they collect interest on nothing.

What a racket, huh?

MONEY SOUP:

But

the story doesn’t stop there. This newly created money goes

out into the economy and it dilutes down the value of

the dollars that were already out there. My lovely wife

Charlene cooks an amazing homemade chicken tortilla soup.

The broth is amazing. Now, if I were to add a gallon of

water to the cauldron, it would ruin the broth. But this is

analogous to what’s happening with the money supply.

Injecting this “money created from nothing” into the economy

is like pouring water into a wonderful pot of soup.

So

by throwing more and more money into the US “economic soup,”

the money gets weaker and weaker and weaker and we have the

phenomenon called inflation which is the appearance of

rising prices. But inflation is just the “appearance” of

rising prices. In reality, prices are not really rising.

Inflation is a result of our money falling in value, more

commonly referred to as the “devaluation of the dollar.” If

this dollar devaluation continues, our money will be more

useful as toilet paper than as a medium of exchange. So

by throwing more and more money into the US “economic soup,”

the money gets weaker and weaker and weaker and we have the

phenomenon called inflation which is the appearance of

rising prices. But inflation is just the “appearance” of

rising prices. In reality, prices are not really rising.

Inflation is a result of our money falling in value, more

commonly referred to as the “devaluation of the dollar.” If

this dollar devaluation continues, our money will be more

useful as toilet paper than as a medium of exchange.

And

with the recent housing crisis, I’m sure that you are all

familiar with the fact that, when you get that bank loan of

money created out of nothing, the bank wants something from

you. It wants you to sign on the dotted line and pledge

your house, your car, your inventory, your assets so that in

case for any reason you cannot continue to make your

payments they get your assets. The banks are NOT

going to lose anything on this. Whether it’s expansion or

contraction, inflation or deflation, the banks are covered

and we like sheep go right along with it because we haven’t

figured it out, we don’t know that this is a scam.

There

you have in a condensed form a crash course on the Federal

Reserve System. I can assure you that you now know more

about The Fed than you probably would if you enrolled in a

four year course in economics because they don’t teach this

in school.

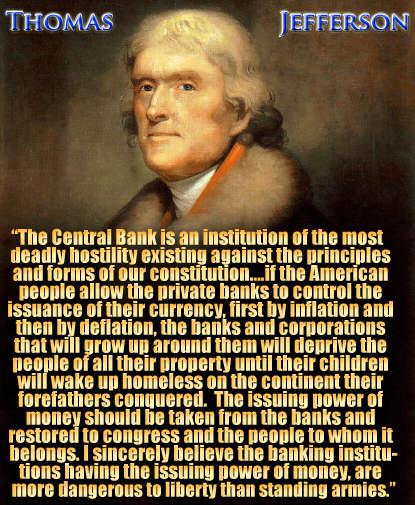

CLOSING:

In

closing, let’s hear from one of the most influential

Founding Fathers of the United States:

So, in

light of the recent financial chaos in America, I ask you

this question: Will the private bankers who own The Fed

help stabilize our markets?

I

leave you with this thought: In the Bible, we learn that the

debtor is a slave to the lender. That is the relationship of

the USA to The Federal Reserve System. In essence, we are

all slaves to the international private bankers who

own The Fed.

If you want to learn more about the Federal Reserve System,

I strongly recommend

The Creature from Jekyll Island

by G. Edward Griffin. It is the

“magnum

opus”

of books on this topic.

Until next time, thanks and

God bless you all.

And please

REMEMBER: Cancer does NOT have to be a death

sentence!

|